Table of Content

Fees on account of external opinion from advocates / technical valuers, as the case may be, is payable on an actual basis as applicable to a given case. Such fees is payable directly to the concerned advocate / technical valuer for the nature of assistance so rendered. The customer shall pay the premium amounts directly to the insurance provider, promptly and regularly so as to keep the policy / policies alive at all times during the pendency of the loan. Up to 1.25% of the loan amount or ₹3,000 whichever is higher, plus applicable taxes. For NRI customers, HDFC Bank has also offered NRI Account Opening Assistance helpline number to process the account opening smoothly.

Working Capital, Debt Consolidation, Repayment of Business Loan, Expansion of business, Acquisition of Business asset or any similar end usage of funds. Do not miss a chance to lower your loan repayments when there may be smarter options to choose from. Do not miss a chance to lower your loan repayments when you have smarter options to choose from. We'll ensure you're the very first to know the moment rates change.

Home Loan EMI Calculator

Make sure you receive this number in case the bank misses it, and save this information until your problem has been resolved. Dial 2 - to report loss or damage of credit or debit card issued in the holder’s name. There are about 1000 products that we offer along with the right mix of finance. Title deeds with previous chain of property-related documents.

The new rate of interest will be as per the prevailing applicable rate of Resident Indian loans . This revised rate of interest would be applicable on the outstanding balance being converted. A letter is given to the customer confirming the change of status. HDFC Bank is one of the India’s leading private banks that offer multiple banking products on its platform.

HDFC Bank NRI Customer Care

The other offer in the same context provides a home loan ranging from 5lakh-10 crore for a tenure ranging from 1-30 years at interest rates ranging from 8.65%-8.70% with the similar processing fee as mentioned earlier. HDFC Limited Bank NRI Home loan amount ranging from 5lakh-10 crore is provided for a tenure ranging from 1-30 years at interest rates ranging from 8.35%-8.60% floating and a processing fee of 0.50% which is Rs11800. One of the most lucrative investments for the NRIs is buying a house in the home country especially when the value of the Indian rupees compared to other currencies is pretty lower. The value of the American dollar is considerably higher as compared to the Indian Rupee so buying a home in India would be a great opportunity for these NRIs to stay close to their country as well as make an investment for the same purpose. Managing an NRI home loan has become all the more easier with the new and upgraded technology. NRI home loans provide all the necessary facilities to the applicants so that they can avail the home loan in their home country without any hassle.

The bank offers 24×7 customer care service to its customer to resolve any queries, complaints and grievances. Customers can connect with HDFC Bank Customer Care through SMS, Call and Email. Dial 1 - for details on the bank account, credit card, loan or any other services. Sometimes it is possible that you may need to address your specific queries or concerns to the Nodal Officer or the Zonal officer of your branch.

Checking your browser before accessing www.hdfcbank.com.

If you purchase an under construction property you are generally required to service only the interest on the loan amount drawn till the final disbursement of the loan and pay EMIs thereafter. In case you wish to start principal repayment immediately you may opt to tranche the loan and start paying EMIs on the cumulative amounts disbursed. We curate the best available offers from banks, NBFCs & financial institutions according to your profile, credit score, cash needs & repayment capacity. This loan can be availed by a person who is a citizen of India but is residing abroad.

If the documents are in a language other than English then an English translation from a professional translator will be required. The above list is indicative in nature and additional documents can be asked for. If you don’t get a satisfactory response from any the above-mentioned channels within a turnaround time of 30 working days of registering a complaint then you may approach the Banking Ombudsmen. When you press 3 your call will be directed to the loan department and you can directly talk to a loan expert about your home loan queries.

None of your efforts are required in calculating the amount for the repayment. Instead an online EMI calculator can be used by the borrowers to calculate details like loan amount, interest rates, and tenure of the loan as well as the processing charges. The HDFC Limited NRI Home Loan EMI calculator will help you calculate the EMI and accordingly the loan amount can be entered till a suitable EMI is arrived at. For details on bank account, credit card, loan or any other services dial 1. In the event of you relocating back to India, HDFC reassesses the repayment capacity of the applicant based on Resident status and a revised repayment schedule is worked out.

Our systems ensure complete data security and privacy for each applicant. All the information contained herein above is for awareness and customer convenience and is intended to only act as an indicative guide about HDFC’s products and services. For detailed information about HDFC’s products and services kindly visit the nearest HDFC branch.

Below give are toll-free numbers for NRI account opening assistance. Please note that the branches are closed on Sundays, national holidays and region-specific public holidays. However, in case you want to report a loss or theft of your Debit / Credit / ATM / Forex / Prepaid / Bearer Card, the bank is primarily available 24 hours on all days, including Sundays and Holidays.

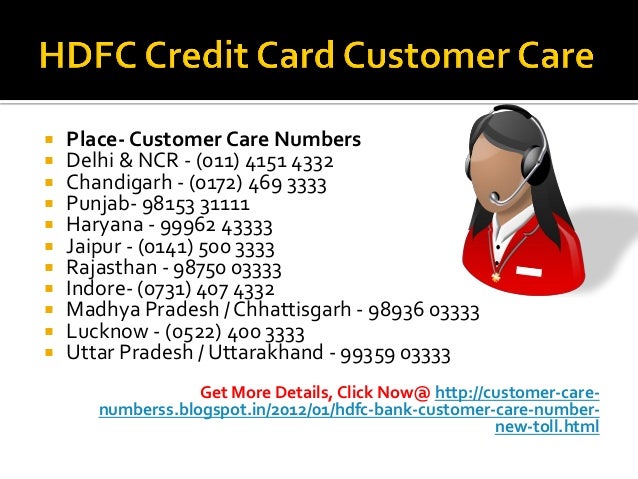

You can apply for housing loans at any time once you have decided to purchase or construct a property, even if you have not selected the property or the construction has not commenced. You can even apply for a home loan whilst you are working abroad, to plan for your return to India in future. The prepayment charges are subject to change as per prevailing policies of HDFC and accordingly may vary from time to time which shall be notified on . You can get in touch with HDFC Bank customer care service for all your Banking needs on their toll-free helpline numbers made available regionally as well as of the official branch. Applying for loans and credit cards through MyMoneyMantra is 100% safe & secure.

No comments:

Post a Comment